Pension Calculator

Pension Book - Identification particulars

Pension Book - Malayalam

PRISM Latest Circular -Dtd :30.08.2019

PRISM Latest Circular in Finance Department

Guidelines-21.04.2017

New User & Online Pension Book Submission-Help File

PRISM - e-Submission of pension papers-Circular

Various Pension Orders

Various Pension Related Forms

Pension Book - Identification particulars

Pension Book - Malayalam

ഹെല്പ്പ് ഫയലുകള് താഴെ ചേര്ത്തിരിക്കുന്നു.

PRISM Latest Circular -Dtd :30.08.2019

PRISM Latest Circular in Finance Department

Guidelines-21.04.2017

New User & Online Pension Book Submission-Help File

PRISM - e-Submission of pension papers-Circular

Various Pension Orders

Various Pension Related Forms

GO(P)120/2019/FIN DT:30/08/2019

"SUBMIT TWO COPIES OF IDENTIFICATION PAGE(I.e page 33) WITH JOINT PHOTOGRAPH AFFIXED AND SPECIMEN SIGNATURE DULY ATTESTED ALONG WITH SERVICE BOOK TO AG FOR ATHORIZING PENSION AFTER SUBMITTING ONLINE APPLICATION"

PRISM ONLINE APPLICATION: INSTRUCTION FROM DPI

PA(1)/46047/2018/DPI DT:13/02/19 .

CIRCULAR NO.16/19/FIN DT:25/02/2019

PRISM USER REGISTRATION CLICK HERE.

K.E.R CERTIFICATE ( AIDED SCHOOL CERTIFICATE)

FORM FOR AFFIXING PHOTOGRAPH AND FURNISHING IDENTIFICATION PARTICULARS AND SPECIMEN SIGNATURE: PAGE 33 PENSION BOOK( 2 COPIES WITH JOINT PHOTO,SPECIMEN SIGNATURE & LEFT HAND THUMP IMPRESSION HAVE TO BE SUBMITTED WITH PRISM PENSION APPLICATION)

CIRCULAR NO.16/19/FIN DT:25/02/2019

PRISM USER REGISTRATION CLICK HERE.

K.E.R CERTIFICATE ( AIDED SCHOOL CERTIFICATE)

FORM FOR AFFIXING PHOTOGRAPH AND FURNISHING IDENTIFICATION PARTICULARS AND SPECIMEN SIGNATURE: PAGE 33 PENSION BOOK( 2 COPIES WITH JOINT PHOTO,SPECIMEN SIGNATURE & LEFT HAND THUMP IMPRESSION HAVE TO BE SUBMITTED WITH PRISM PENSION APPLICATION)

OTHER IMPORTANT ORDERS REGARDING PENSION

- ISSUE OF NON LIABILITY CERTIFICATE IN RESPECT OF CLERGY,MONKS AND OFFICERS WITHOUT PROPERTY :CLARIFICATION.CIRCULAR NO.80/2019/FIN DT:24/09/2019

- Disbursement of pensionery benefits:Guidelines.GO(P)55/2019/FIN DT:04/05/19

- PRISM:APPLICATION OF PENSION:NEW INSTRUCTIONS.GO(P)120/2019/FIN DT:30/08/2019

- RECKONING OF BROKEN AIDED SCHOOL SERVICE AS QUALIFYING SERVICE FOR PENSION.JUDGEMENT IN WA 1235/2018

PRISM

Step-1 : Go to http://prism.kerala.gov.in

Step-2: Go to the 'New user registration' for sign up.(During signup please enter the details like PEN, DOB and thenclick on check' whether other details are correctly beingpopulated,then enter Mobile number and e-mail addressand click to Register as an employee).

Step-3: Wait to get an SMS to the registered mobile number.(After you enter the details,prism administrator(i.e Asst.nodal officers in AEO/DDE) will verify the details which you have entered. After the verification process ,you will get a 'user name and a password' via SMS)

Step-4: Now you are ready to log in. Go to the home page again and login using the username and password received along with a captcha you will get a welcome screen.Left top corner of the screen you can see your name.Similarly on right top screen you can see . your login status as an employee.

Step-5: On left top in red colour, you can see a link as"pension e- filing"-click here to begin.

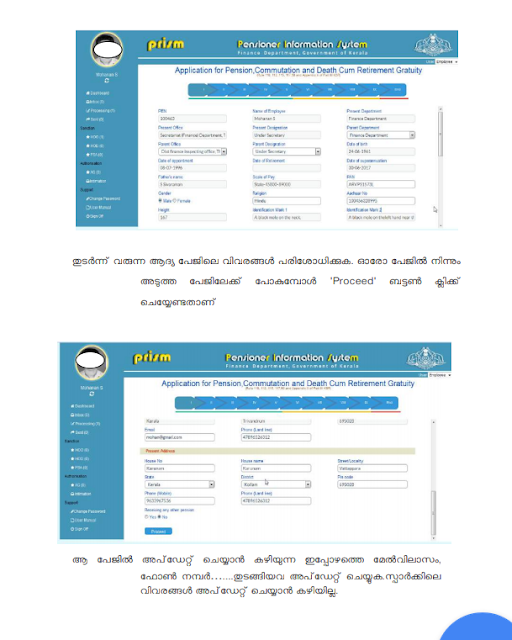

Step-6: Soon after you click on "pension e- filing" you will get a space to give your details one by one. Fill those columns with extreme care. There are total 10 pages to fill and you will get a dialogue box to proceed from one page to the next. In the first page some information seen cannot be edited which come from SPARK.

Step-7: You are requested to fill the pages one by one with extreme care, without making any errors."Proceed"button should be clicked to move from one page to the end (In case you logout by mistake before completing the procedure you can start with the link 'processing'from where you had stopped just before you logged out)

Step-8: After all entries are made, go to 'view report'.

Step-9: After you viewed your report to make sure that there isno error in those details given by you,select the officer and 'submit' the application after e-signing the document on receiving OTP.

Step-10: All steps are over now, the details which you had entered is now available in the inbox of your Head of Office/Head of the Department. Now you can log out from the portal.